- Joined

- Sep 26, 2021

- Posts

- 8,103

- Main Camera

- Sony

We have another thread on this:

/cdn.vox-cdn.com/uploads/chorus_asset/file/24002574/acastro_STK094_03.jpg)

The fanfic on this one is spicy.

- Cmaier

- Replies: 11

- Forum: Technology

We have another thread on this:

/cdn.vox-cdn.com/uploads/chorus_asset/file/24002574/acastro_STK094_03.jpg)

vmst.io

vmst.io

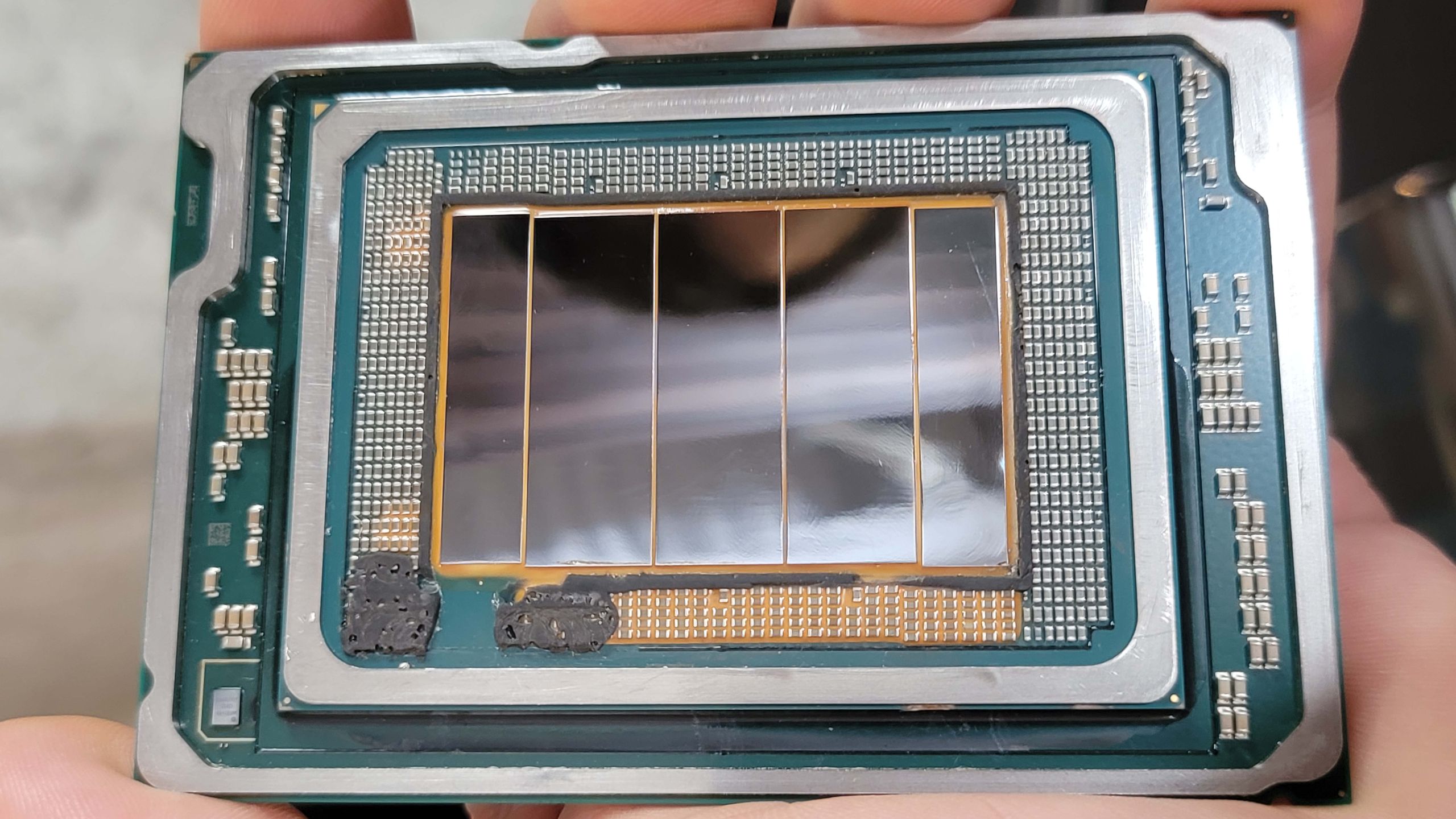

Forget Lunar Lake; If there's one chip family that serves as the lynchpin for Intel’s entire turnaround plan, it's this – the company’s coming Clearwater Forest Xeon that it revealed for the first time at a recent event. The chip family is exceedingly important because this is the first high-volume chip to be fabbed on the Intel 18A process node, a node so critical that Intel CEO Pat Gelsinger has said he has bet the entire company on it.

If Intel can produce those chips economically, they will be the key to its turnaround, particularly because it will entice other companies to have their own chips made at Intel Foundry. If Intel can’t punch these chips out in high volume or is beset by delays, we could be looking at a future that doesn’t include an Intel that resembles its current form.

I very much agree with a slight quibble that I think Intel did switch to the same EDA tools as the rest of the industry.That second quote makes no sense to me. Nobody says to themselves “intel was able to produce its own chips economically, so i am enticed to make my chips on Intel’s foundry.”

Foundry decisions are much more complicated than that, involving whether the fab can presently achieve performance targets, price of doing so (a function of yield and other things), and the features and capabilities of the process (e.g. “i need power and ground planes for my design - is there a maximum area design rule that would prevent that?”). It also, often even more importantly, takes into account the future: what will happen to prices over time, what will the next node look like, will they be able to launch the next node on time and meeting my performance/cost requirements, or am i going to have to switch back to TSMC after this round?

Important to understand: it’s going to take a sustained period of good execution before very many people trust their designs to Intel’s fabs. This is particularly the case because Intel doesn’t speak the same language as the rest of the industry, doesn’t use the same EDA tools as the rest of the industry, and is not historically setup to providing design teams outside of Intel with what they need.

I don’t think that’s true, at least not across-the-board. While I believe they support those tools (Cadence, synopsys, etc.) for foundry customers, from what I’ve heard they still use their own mess of tools when designing their own chips for their own fabs.I very much agree with a slight quibble that I think Intel did switch to the same EDA tools as the rest of the industry.

Really? Huh I thought they had switched completely. One would’ve thought going to TSMC N3B for Lunar Lake/Arrow Lake would’ve necessitated such a switch.I don’t think that’s true, at least not across-the-board. While I believe they support those tools (Cadence, synopsys, etc.) for foundry customers, from what I’ve heard they still use their own mess of tools when designing their own chips for their own fabs.

In 2017, Samsung separated its chip manufacturing operations from its design unit to address customer concerns about potential conflicts of interest. However, some clients still worry that the foundry and design divisions may share sensitive information, which undermines confidence in Samsung's neutrality.

No one seems particularly concerned or at least voicing those concerns with Intel as a foundry.

I haven’t seen it in print the way I just saw it written about for Samsung. Or at least I don’t remember seeing it. And yet if it’s a problem for Samsung then yes it should be a concern for Intel as well I would think. So I don’t doubt your statement.Really? That’s not what I hear. It’s not like people are going to publicly announce stuff, but the fact that Intel’s foundry business isn’t getting a lot of takers is partly because Intel is historically untrustworthy.

Intel's struggles to land customers for its Intel Foundry unit raised concerns over viability of Pat Gelsinger's IDM 2.0 strategy and resurrected rumors about the company's possible plans to spin off or sell its manufacturing capacity. But only a few companies worldwide can potentially afford and operate Intel's fabs. One of them is TSMC, and it says it is not interested in acquiring those facilities.

US would never allow such a transaction anyway. Global Foundries is the most likely possible purchaser.

TSMC is not interested in buying Intel's fabs

Why buy fabs if you have your own?www.tomshardware.com

Do they even have the money to buy/operate Intel’s foundries? Also GloFo rather pointedly got out of the leading edge race, would they want back in?US would never allow such a transaction anyway. Global Foundries is the most likely possible purchaser.

oh, i have no idea if they’d have any interest or financial ability. Just saying they’re the only one that would get approval.Do they even have the money to buy/operate Intel’s foundries? Also GloFo rather pointedly got out of the leading edge race, would they want back in?

I don’t think 18A was ever going to be this early but there were supposedly plans for its sister node 20A to produce some Arrow Lake dies though those plans were apparently shelved and now everything this generation is TSMC 3nm.I read that 18Å had some delightful features involving elaborate layering and backside power delivery, but Lunar Lake seems to be on N3, so Intel must still be struggling to get the process reasonably stable.

www.notebookcheck.net

www.notebookcheck.net

This took 15 years. That’s a very long period of uncertainty for every company involved. The EU is a horrible place to do business. Regulatory uncertainty is not a good thing.Some rare good news for Intel:

Intel stock on the rise as EU anti-trust probe ends in nothing

After escaping a fine of over $1.1 billion, Intel is now free of all the legal trouble connected to the nearly two-decade-long fight with EU regulators, thanks to a decision of the EU Court of Justice. The tech giant had been accused of trying to block AMD by awarding rebates to Lenovo, Dell...www.notebookcheck.net

Also shows that European Courts can disagree with the European Commission on the matters of application of the law, something to consider if/when the EU commission makes regulatory judgements against Apple. They will not necessarily be upheld. That said, in this particular case I am a little surprised as I'm pretty sure the US successfully fined Intel for this exact practice and its not exactly like the US is known for stronger anti-trust measures in general. Also of note, the final judgement in this case today stems from a fine from 2009 and a General Court decision in 2022. Holy shit. And I thought US court cases wormed their way through the system slowly.

This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register.

By continuing to use this site, you are consenting to our use of cookies.