You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Fall of Intel

- Thread starter Eric

- Start date

Thing is, you gotta bend over extremely far to be that fair, perhaps so far it isn't fair.If we're bending over backwards to be fair, 18A is the first node meant for customers at volume and so we could say that the success or failure of Intel's latest attempt to be a foundry is currently unknown. Previously they attempted to be a foundry without abandoning the internal tools that Intel chip designers used to make their own chips and the result was predictably a disaster as customers were using a different set of tools than what the foundry was designed to use.

Intel started these efforts at least as far back as 22nm - that's the node where they began signing up FPGA companies. Not just Altera, but a startup named Achronix. IIRC, at that time there was word going round that Intel also wanted business from other kinds of fabless semiconductor companies, but couldn't get much interest.

Altera got bought because Intel wanted a captive additional fab customer. (Another reason was that there was a lot of buzz around the idea that FPGAs were about to become super important in the data center.)

Achronix is still around, but even though their first generation products were exclusively built on Intel 22, they never used Intel as a foundry again (today, they use TSMC 7). I admit this is speculation, but it's speculation that potential Intel foundry customers very much would have been doing too: what if one reason why Achronix parted ways with Intel so quickly was that Intel acquired its own FPGA product line, and didn't want to give a competitor access to the same fabs?

That would have always been on everyone's mind. Why should you risk fabbing anything with Intel? They might turn around and design or acquire their own equivalent and lock you out of their fabs.

Finally, I'll note that Intel 22 first shipped for revenue in 2012 (in the form of Ivy Bridge family chips). So, they've been trying to offer foundry services for at least 12 years (realistically, more than that - they would've been talking to Altera and Achronix before 22nm was production ready). They have absolutely been intending to sell foundry services at volume for a very long time, over a lot of nodes. They just haven't been any good at fulfilling the technical or reputational requirements needed to make Intel foundry services attractive.

and as I believe I've seen @Cmaier say, Intel's current disorganized flailing certainly isn't doing them any favors on that latter requirement.

A successful launch for Intel:

www.notebookcheck.net

www.notebookcheck.net

The B580 is getting good reviews, is at a good price point, and is reportedly selling out - and is doing so because of high demand rather than low supply. As the article says, it may be a rare bright spot in and otherwise pretty bad year for Intel, but it’s a win nonetheless.

Intel Arc B580 sells out amid high demand; weekly restocks planned

Intel's Arc B580 "Battlemage" GPU has become a surprise hit, selling out quickly at $250. With 12GB VRAM and competitive performance against RTX 4060 and RX 7600, it marks a turnaround for Intel's graphics division after previously losing its entire market share. Weekly restocks are planned to...

www.notebookcheck.net

www.notebookcheck.net

The B580 is getting good reviews, is at a good price point, and is reportedly selling out - and is doing so because of high demand rather than low supply. As the article says, it may be a rare bright spot in and otherwise pretty bad year for Intel, but it’s a win nonetheless.

How seriously should this lawsuit be taken?

www.tomshardware.com

www.tomshardware.com

Intel ex-CEO Gelsinger and current co-CEO slapped with lawsuit over Intel Foundry disclosures — plaintiffs demand Gelsinger surrender salary earned

LR Trust wants Pat Gelsinger and David Zinsner to return their compensation.

LR Trust, an Intel shareholder, has filed a lawsuit related to the performance of Intel Foundry and against former and current executives as well as directors of the company (as discovered by The Register). The lawsuit accuses Pat Gelsinger, the former chief executive of Intel, and David Zinsner, an interim co-CEO and CFO of Intel, of mismanagement, misleading disclosures, and demanding the return of their compensations and other gains to the company.

- Joined

- Sep 26, 2021

- Posts

- 8,102

- Main Camera

- Sony

Always hard to tell in these derivative suits. Misleading disclosures would be the strongest claim, if true.How seriously should this lawsuit be taken?

Intel ex-CEO Gelsinger and current co-CEO slapped with lawsuit over Intel Foundry disclosures — plaintiffs demand Gelsinger surrender salary earned

LR Trust wants Pat Gelsinger and David Zinsner to return their compensation.www.tomshardware.com

Is asking for the CEO's compensation back a typical penalty to ask for? I'm not sure I've seen that before, but I don't follow a lot of these types of lawsuits too closely.Always hard to tell in these derivative suits. Misleading disclosures would be the strongest claim, if true.

- Joined

- Sep 26, 2021

- Posts

- 8,102

- Main Camera

- Sony

no, i haven’t seen that re: normal compensation but I have seen attempts to claw-back post-job compensation (i.e. the payouts the CEO gets when he leaves)Is asking for the CEO's compensation back a typical penalty to ask for? I'm not sure I've seen that before, but I don't follow a lot of these types of lawsuits too closely.

Altera officially spun back out of Intel - is still owned by Intel until the seemingly inevitable IPO.

www.tomshardware.com

www.tomshardware.com

www.tomshardware.com

www.tomshardware.com

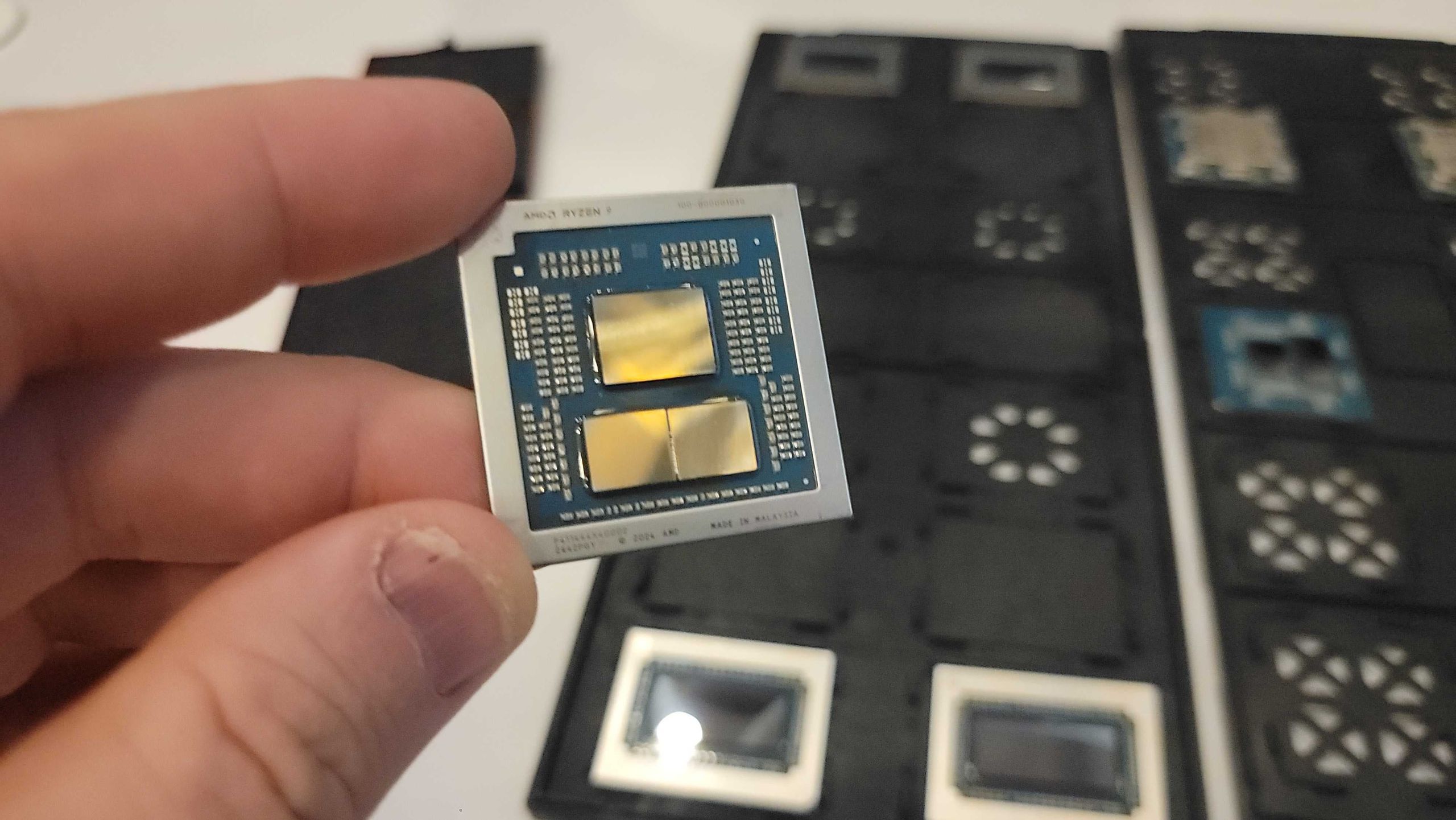

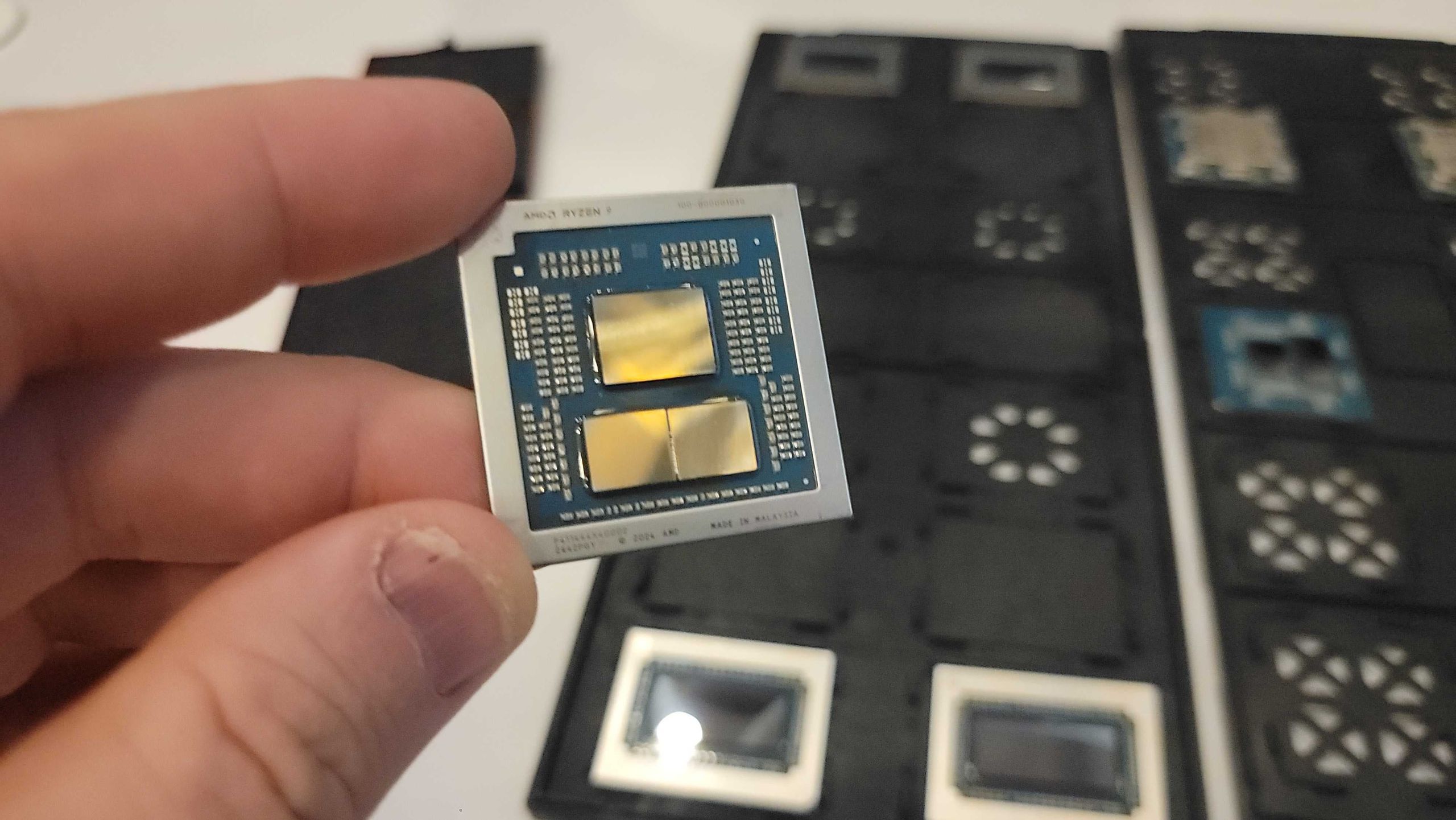

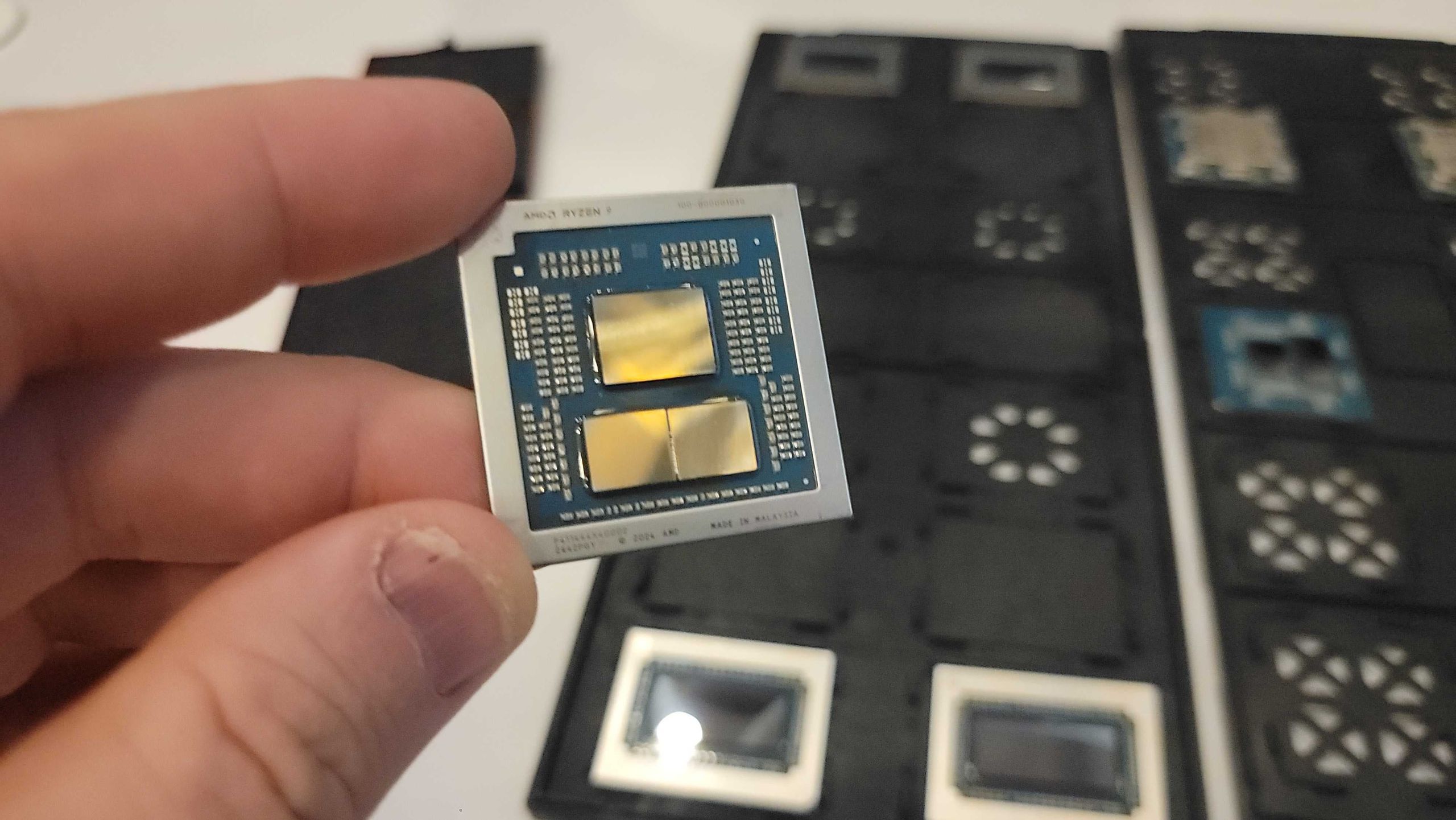

AMD taking a victory lap over Intel saying demand for their 3D V-cache gaming processors is not just due to them having a great product, but Intel having an especially bad one.

Ouch.

Also Intel’s “fixes” for Arrow Lake do nothing and recent Windows updates make AMD look even better.

Altera officially announces independence from Intel — the company strives to expand FPGA portfolio

But it is still an Intel company.

AMD says Intel's 'horrible product' is causing Ryzen 7 9800X3D shortages

Team Blue in the rearview.

AMD taking a victory lap over Intel saying demand for their 3D V-cache gaming processors is not just due to them having a great product, but Intel having an especially bad one.

"We knew we built a great part. We didn't know the competitor [Intel] had built a horrible one," quipped AMD executive Frank Azor. "So the demand has been a little higher than we forecasted."

Ouch.

Also Intel’s “fixes” for Arrow Lake do nothing and recent Windows updates make AMD look even better.

We found the patch does nothing to help (at least on two motherboards) and that the newer Windows revision required for the fix has benefited competing processors more, thus making Intel's Arrow Lake competitive positioning even worse than at launch. We'll publish that testing soon.

A successful launch for Intel:

Intel Arc B580 sells out amid high demand; weekly restocks planned

Intel's Arc B580 "Battlemage" GPU has become a surprise hit, selling out quickly at $250. With 12GB VRAM and competitive performance against RTX 4060 and RX 7600, it marks a turnaround for Intel's graphics division after previously losing its entire market share. Weekly restocks are planned to...www.notebookcheck.net

The B580 is getting good reviews, is at a good price point, and is reportedly selling out - and is doing so because of high demand rather than low supply. As the article says, it may be a rare bright spot in and otherwise pretty bad year for Intel, but it’s a win nonetheless.

Will be interesting to see how it fares once 50 series RTX is out and reflex 2 frame warping is a thing.

I know 50 series is copping a lot of shit at the moment, but the combination of DLSS4 and reflex 2 is going to kill AMD and intel GPUs unless they come up with a similar technology and actually get it adopted ASAP before the developers commit to DLSS4 and reflex 2.

I say that as an all AMD system owner (CPU+GPU) since 2018 on the PC side.

The full review of Intel’s “fixes” is out and it’s pretty damning.Altera officially spun back out of Intel - is still owned by Intel until the seemingly inevitable IPO.

Altera officially announces independence from Intel — the company strives to expand FPGA portfolio

But it is still an Intel company.www.tomshardware.com

AMD says Intel's 'horrible product' is causing Ryzen 7 9800X3D shortages

Team Blue in the rearview.www.tomshardware.com

AMD taking a victory lap over Intel saying demand for their 3D V-cache gaming processors is not just due to them having a great product, but Intel having an especially bad one.

Ouch.

Also Intel’s “fixes” for Arrow Lake do nothing and recent Windows updates make AMD look even better.

Intel's Arrow Lake fix doesn't 'fix' overall gaming performance or match the company's bad marketing claims - Core Ultra 200S still trails AMD and previous-gen chips

The 'fix' isn't good enough to fix bad marketing claims.

These tactics and the test results make this whole 'fix' exercise feel more like simple misdirection and spin than an actual fix.

At the end of the day, Intel’s fixes for its various failings did not demonstrably ‘fix’ the Core Ultra 9 285K’s gaming performance in any meaningful way, and they certainly aren't enough to meet the company’s original marketing claims or change the competitive positioning of its lackluster Arrow Lake chips. In fact, it looks like Arrow Lake is moving backward. Despite its other positive attributes, the Core Ultra 285K simply isn’t the best option for gaming.

One of the only real, tangible improvements came from Cyberpunk 2077 but that was developer bug that had nothing to do Intel per se and fixed issues with both Arrow Lake and Raptor Lake. Thus CDPR’s fix didn’t improve Arrow Lake wrt its predecessor and it wasn’t Intel’s doing. But naturally Intel included as a win in their slides.

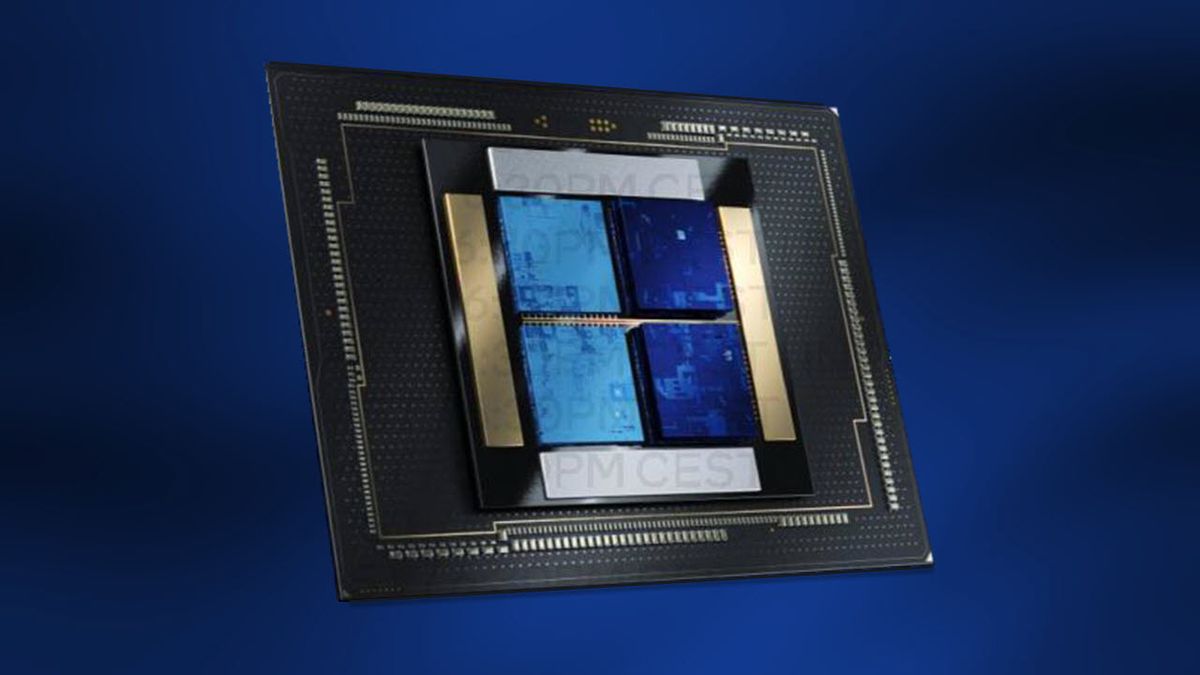

Intel cancels Falcon Shores AI GPU:

www.tomshardware.com

www.tomshardware.com

Won’t have a successor for another 2 years.

Intel cancels Falcon Shores GPU for AI workloads — Jaguar Shores to be successor

A radical temper of expectations.

Won’t have a successor for another 2 years.

Yoused

up

- Joined

- Aug 14, 2020

- Posts

- 8,380

- Solutions

- 1

When I look at top500, the two top slots are held by EPYC, with AMD compute cards (not GPUs but a similar sort of architecture – like tailored GPGPUs). #3 is Xeon, with Intel-design compute cards. When you look at efficiency, the AMD system is getting around 59 TFLOPs/kW compared to 26 for the Intel SC.

Down the list at #7 is an nVidia Grace Hopper "superchip" installation (ARM processors with nVidia-design embedded compute cores in bridged semi-UMA) which has a much smaller core count than the others (around a quarter) but is getting 61TFLOPs/kW. Whether its energy efficiency would scale linearly is uncertain.

Down the list at #7 is an nVidia Grace Hopper "superchip" installation (ARM processors with nVidia-design embedded compute cores in bridged semi-UMA) which has a much smaller core count than the others (around a quarter) but is getting 61TFLOPs/kW. Whether its energy efficiency would scale linearly is uncertain.

AMD outsells Intel in the datacenter for the first time in Q4 2024

But sales of Instinct GPUs disappoint.

AMD outsells Intel in the datacenter for the first time in Q4 2024

- Joined

- Sep 26, 2021

- Posts

- 8,102

- Main Camera

- Sony

I don’t think that’s right? I seem to recall a quarter or two in the 90’s where we did that. Briefly.

AMD outsells Intel in the datacenter for the first time in Q4 2024

But sales of Instinct GPUs disappoint.www.tomshardware.com

AMD outsells Intel in the datacenter for the first time in Q4 2024

Isn't a lot of (or even most of) the reason Intel fell behind TSMC in node size that: (a) these smaller nodes require EUV lithography; (b) the only company that makes EUV lithography machines is ASML; and (c) TSMC began acquiring and working with the ASML EUV machines several years before Intel?

Yes, there's more to small nodes than the lithography. But given Intel's substantial technical expertise, it seems reasonable to expect that they could have had had the same success as TSMC, if they acquired the machines early on and made a serious push to incoporate them into their production.

It's also ironic that Intel was so slow in adopting the ASML machines, since they're a part-owner of ASML, and contributed to the consortium that led to the company's formation.

Yes, there's more to small nodes than the lithography. But given Intel's substantial technical expertise, it seems reasonable to expect that they could have had had the same success as TSMC, if they acquired the machines early on and made a serious push to incoporate them into their production.

It's also ironic that Intel was so slow in adopting the ASML machines, since they're a part-owner of ASML, and contributed to the consortium that led to the company's formation.

Last edited:

The lack of EUV was part of it, but Intel's struggles with 10nm began after 2014 while the first real commercial EUV node from TSMC was 2019 and even by then people were joking about 14nm+++. Intel I think was supposed to release 10nm around 2016, which obviously didn't happen. So with respect to manufacturing Intel not adopting EUV faster certainly hurt (I think Intel 4 in 2023 was their first), but other factors did as well.Isn't a lot of (or even most of) the reason Intel fell behind TSMC in node size that: (a) these smaller nodes require EUV lithography; (b) the only company that makes EUV lithography machines in ASML; and (c) TSMC began acquiring and working with the ASML EUV machines several years before Intel?

Yes, there's more to small nodes than the lithography. But given Intel's substantial technical expertise, it seems reasonable to expect that they could have had had the same success as TSMC, if they acquired the machines early on and made a serious push to incoporate them into their production.

It's also ironic that Intel was so slow in adopting the ASML machines, since they're a part-owner of ASML, and contributed to the consortium that led to the company's formation.

But Intel had other issues beyond manufacturing. There was missing the mobile phone market which happened before 2014 and more recently a struggle to compete in selling AI chips again which is not necessarily tied to their fabrication woes.

Sorry, not following. What's the relevance of Intel's struggles with 10 nm beginning after 2014?The lack of EUV was part of it, but Intel's struggles with 10nm began after 2014 while the first real commercial EUV node from TSMC was 2019 and even by then people were joking about 14nm+++. Intel I think was supposed to release 10nm around 2016, which obviously didn't happen. So with respect to manufacturing Intel not adopting EUV faster certainly hurt (I think Intel 4 in 2023 was their first), but other factors did as well.

Also just found this discussion on Reddit from 4 years ago. One poster said Intel did try EUV early on, but walked away after encountering too many technical difficulties, while TSMC persisted (and there was sentiment at the time that EUV was unworkable). Another said that early EUV worked much better for small dies than large dies, making it more suitable for TSMC than Intel.

Last edited:

Sorry, not following. What's the relevance of Intel's struggles with 10nm beginning after 2014?

Also just found this discussion on Reddit from 4 years ago:

To demonstrate that the lack of EUV was not the sole reason they fell behind TSMC. They were having other manufacturing problems beyond and predating EUV and according to your link may in fact helped cause some of the delay in adopting EUV.

It didn't help that Intel's 10 nm process was in such bad shape that they were unwilling to invest in its meaningful high volume production, so any interest in advanced tools would have to wait until their initially very buggy, quad-patterning 7 nm process was looking better, and was ready for EUV (either due to shrinking tile sizes, pellicle availability, or both).

Had Intel 10nm not been in such bad shape, they would not have fallen anywhere near as far behind TSMC as they did as quickly as they did.

Last edited: